22+ mortgage transfer tax

Web At the time of transfer the property is encumbered by a mortgage in the amount of 3000000 and the property secures a line of credit with an outstanding balance of. Web The cost of the real estate transfer tax differs from state to state with the amount based on the price of the property being transferred.

Home Connolly Capital

Enjoy a host of US.

. Web The sale of tax lien certificates is a solution to a complex problem Sheridan County Wyoming recovers lost revenue needed to fund local services the property owner gets. TurboTax Makes It Easy To Get Your Taxes Done Right. Web Perform a free Wyoming public property records search including property appraisals unclaimed property ownership searches lookups tax records titles deeds and liens.

Closing costs can be as much as 3 5 of your loan amount and a big part of it can be transfer tax. Web M monthly mortgage payment. Staying connected with your local branch is easier than ever.

Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Web Welcome to the Sheridan Branch.

Web And in New York State the transfer tax rate is 2 per 500 of a homes sale price plus a 1 mansion tax for homes that sell for 1 million or more though in New. P the principal amount. Lock Your Rate Today.

Web The IRS places several limits on the amount of interest that you can deduct each year. Web There are more costs than most people realize when you transfer real estate. For tax years before 2018 the interest paid on up to 1 million of acquisition.

Web The District of Columbia imposes a deed transfer tax of 11 on residential property worth less than 400000 and 145 on property worth more than 400000. Web The Mortgage Recording Tax in NYC. They can be as low as a flat.

I your monthly interest rate. No Tax Knowledge Needed. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company.

Ad Compare the Best Home Loans for February 2023. Web In Nevada when real property is transferred such as when a house is sold there is generally a baseline tax of 195 for each 500 in value of the property though. Web Due Date and Tax Rates.

Bank products and services right here including savings and. Get Instantly Matched With Your Ideal Mortgage Lender. Recordation tax is based on the greater of the consideration paid for the transfer of the property or the fair market value of the property.

Web Whenever you obtain a mortgage local governments enforce a mortgage tax to document the loan transaction. The 2023 NYC Mortgage Recording Tax MRT is 18 for loans below 500k and 1925 for loans of 500k or more. Apply Get Pre-Approved Today.

Your lender likely lists interest rates as an annual figure so youll need to divide by 12 for. This is SmartAssets crash course in mortgage tax.

Blu Real Estate

Home Connolly Capital

Pdf Property Transfer Tax And Stamp Duty

Georgia In Imf Staff Country Reports Volume 1998 Issue 099 1998

6 Ways To Get Approved For A Mortgage Without Tax Returns In 2023

What Are Real Estate Transfer Taxes Bankrate

Real Estate Buy Sell Agreement 13 Examples Format Pdf Examples

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

Blu Real Estate

Pdf Integration Of Environmental Policy Into The European Energy Policy Dacinia Crina Petrescu Academia Edu

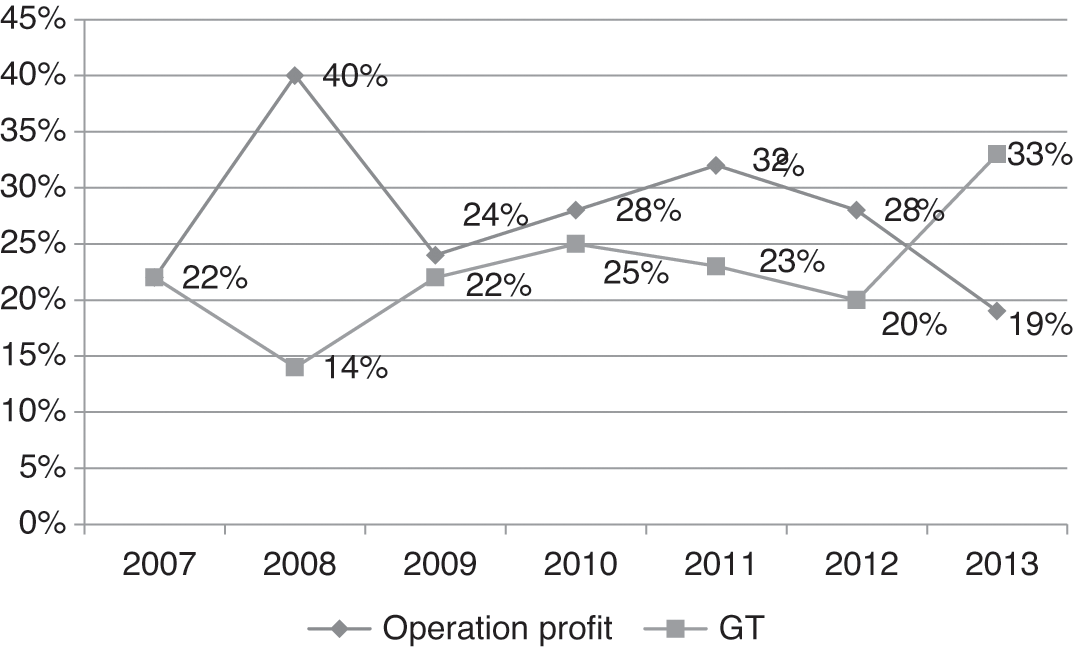

Reforms And Their Effects Part Ii The Israeli Economy 1995 2017

A Taxexempt Htm

22 Sample Real Estate Contracts In Pdf Ms Word

Property Transfer Taxes On Real Estate Selected Countries Download Table

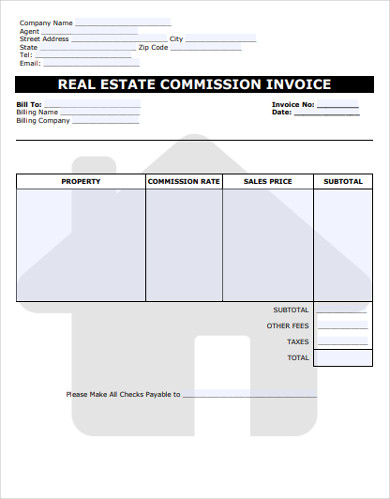

Real Estate Commission Invoice Examples 8 Templates Download Now Examples

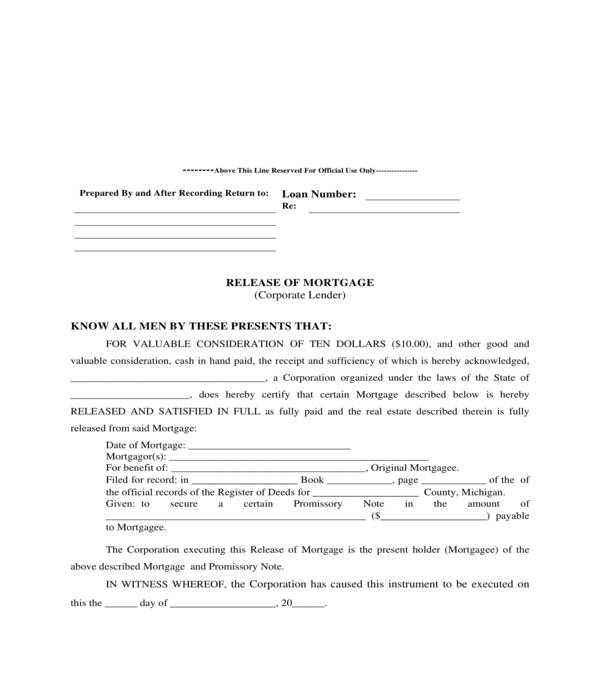

Free 6 Mortgage Release Forms In Pdf Ms Word

Are Total Taxes Higher In The Usa Or Europe Quora